2026 changes in health care costs

Explore Changes in the

ACA Health Insurance Marketplace

What You Need to Know

With health care costs expected to increase, we’re here to help you navigate what’s ahead. At Blue Cross Blue Shield of Wyoming, we offer quality care close to home and a nationwide network of providers, backed by the security of the Cross and Shield.

Why Health Care Costs Are Changing

There are many factors outside your control that influence what you pay for health care — and many of these are beyond BCBSWY’s control. Several changes are expected to put upward pressure on costs, some of which include:

- Enhanced Premium Tax Credit expiration: The enhanced premium tax credits that have helped lower costs since 2021 are scheduled to expire;

- This means you may no longer receive a tax subsidy, or you could receive a smaller one than you do now;

- To make sure you get the biggest tax credit you’re eligible for, please login or create an account here or go to HealthCare.gov before you enroll and update your financial information.

- Government rules require you compare your estimated income from when you applied for your plan to what you actually earned. If you don’t complete this step as part of your annual application, you could lose any federal subsidies that help pay for your plan.

- Shifting Marketplace populations: As healthier individuals leave the Marketplace, the remaining pool often requires more care, which increases expenses for everyone;

- Medical & Prescription Costs: Medical and prescription costs continue to rise, with 2025 projected to see the steepest growth in more than a decade.

While these challenges are significant, understanding them can help you plan ahead and make confident, informed decisions about your coverage.

CHANGING HEALTH INSURANCE COSTS FAQ

If Congress extends the credits, the marketplace will update its website to reflect the revised tax credit.

If you’ve already made a coverage purchase before the update, you can revisit the marketplace to view your new tax credit amount.

If credits are extended, you can claim your updated tax credit by returning to the marketplace and updating and/or verifying your eligibility information.

Yes, Federal assistance is available to help qualifying individuals afford their insurance premiums and out-of-pocket costs. The federal government provides two main types of financial assistance for eligible individuals:

- Advanced Premium Tax Credit (APTC): Helps reduce the cost of your monthly insurance premiums.

- Cost-Sharing Reductions (CSRs): Lowers out-of-pocket expenses such as deductibles, copayments, and coinsurance (only available with Silver-level plans).

Learn more about qualifying for assistance here.

You should verify your application every year to ensure your information, including income, address, and family size, are up to date. Not updating your information can result in added costs – if you’re in a $0 premium plan and don’t update your information during OEP, a $5 monthly fee may apply.

Open Enrollment begins Nov. 1 and ends Jan. 15, 2026. Enroll by Dec. 15 for coverage starting Jan. 1, 2026.

Open Enrollment is your annual opportunity to take charge of your health coverage for the upcoming year. Don’t miss this limited window—if you do, you may have to wait until the next Open Enrollment to make changes. During this time, you can:

- Enroll in a new health insurance plan

- Change to a plan that better fits your needs

- Verify details of eligibility, household size, income, etc.

- Update your details to make sure you receive the right coverage and savings

You may need to wait until the next Open Enrollment—unless you qualify for a Special Enrollment Period triggered by a major life event, such as losing other coverage, getting married, or welcoming a new child. Learn more about Special Enrollment and Qualifying Life Events here.

Several factors impact the changes in next year’s health insurance premiums. Learn more about these factors here.

Starting Nov. 1, you can log in (or create an account) here or login at Healthcare.gov to update your application and view your 2026 health insurance rates.

Going without insurance can create serious risks to your health, finances, and overall well-being. Learn about the risks of forgoing health insurance and the benefits of maintaining coverage here.

You’ve been auto-enrolled in a comparable BCBSWY plan. To keep this coverage, you do not need to take any action as your health insurance will continue automatically.

If you have questions, or would like to make changes, now is the time. You must make changes by December 15, 2025, for them to take effect January 1, 2026.

Contact us for more information at 800.851.2227

QUALIFYING FOR TAX CREDITS

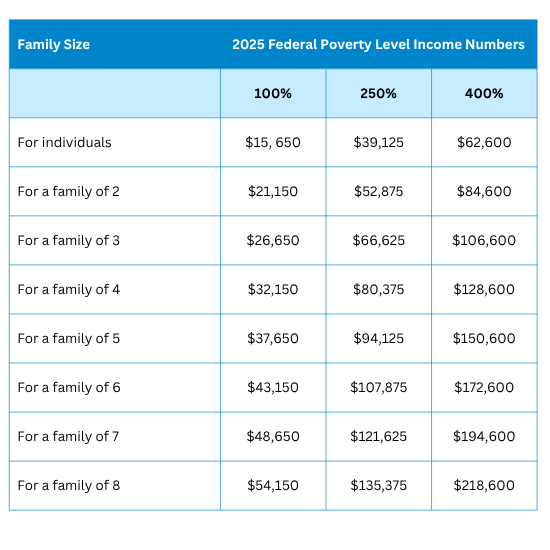

To qualify for Premium Tax assistance, your yearly modified adjusted gross income* must be between 100 and 400% of the FPL.

To qualify for cost share reduction to lower your out-of-pocket costs, your yearly modified adjusted gross income* must be between 100 and 250% of the FPL.

*Income amounts based on the 2025 Federal Poverty Level (FPL), a measure of income updated yearly by the U.S. Department of Health and Human Services (DHHS)

HOW DOES COST SHARE ASSISTANCE IMPACT COVERAGE OPTIONS?

- Cost share reductions is determined by the Health Insurance Marketplace at the time of enrollment.

- Cost share reductions lower your out-of-pocket costs and are available with any BCBSWY Silver plan. Refer to the Silver Plan Guidelines to see how your out-of-pocket might be reduced.

- 250% and below for cost share assistance

Silver Plan Guidelines

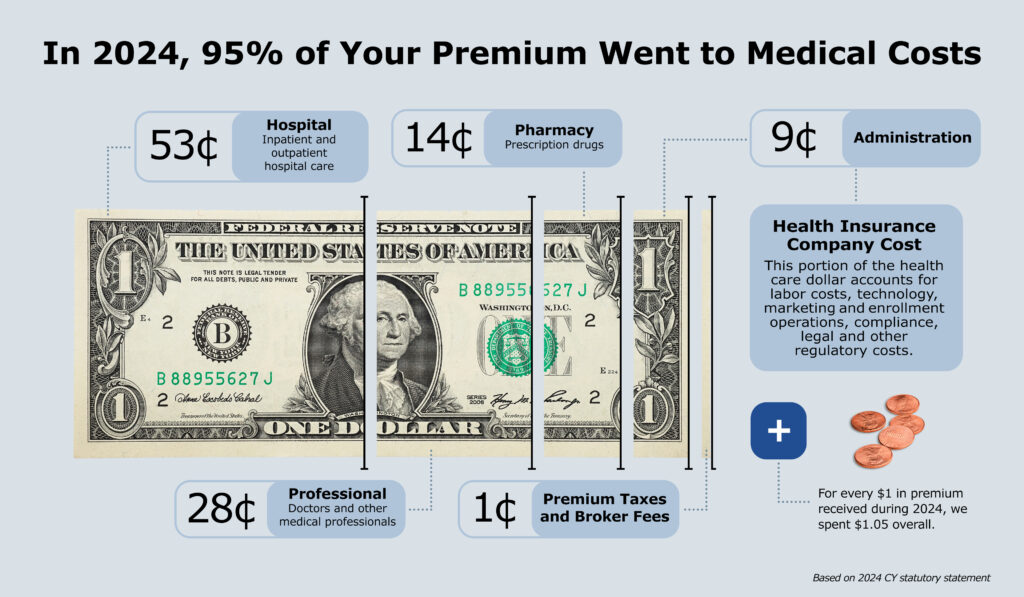

PREMIUM DOLLAR BREAKDOWN

Explore how your health premium dollar breaks down:

2026 Rate Justification for Affordable Care Act (ACA) products

The primary factors considered in determining Blue Cross Blue Shield of Wyoming’s 2026 premium rates for individual and small group products include:

- Expected increase in the cost of medical care for both utilization and cost of services.

- The impact of the Enhanced Premium Tax Credits expiring at the end of 2025.

- The impact of taxes and fees applicable to ACA products.

- Expected changes in the health of the members enrolled in the products.

- Expected impact of the ACA Risk Adjustment program.

- Changes in cost-sharing levels.

WHAT WE’RE DOING TO HELP

We’re building health care that works for you.

- Putting Members First

As a purpose-driven, not-for-profit health insurer, we’re focused on advancing care for Wyoming. - Improving Access to Care

We’re offering $10 copay plans for virtual care visits for urgent care and behavioral health. - Supporting You When It Matters Most

Our member service team is here to help you understand your options and get the care you need. - Helping You Save Money

We’re simplifying how members navigate care and providing tools to make informed, cost-saving decisions. - Listening to Our Communities

We’re investing in key issues like youth mental health to improve care across Wyoming.

WE’RE HERE FOR YOU

We know change can be hard — but you’re not alone. We’ll continue sharing updates as we approach 2026. In the meantime, you can:

- Find an informational event near you

- Text Enroll to 222777

- Stop by one of our eight Member Centers for personalized help

Because you deserve care that’s simple, affordable, and built around your needs.

Informational events

Learn more about ACA changes at one of our informational events. Find an event near you.

Cost assistance

Learn more about cost assistance and see if you may qualify.

Health care glossary

We know health insurance terms can be confusing. Click here to view our glossary of terms.